franklin county ohio sales tax rate 2019

Franklin County collects very high property taxes and is among the top 25 of counties in the United States. The County sales tax rate is.

Sales Taxes In The United States Wikiwand

The Ohio sales tax rate is currently.

. Michael stinziano 2019 property tax rates for 2020 franklin county auditor expressed in dollars and cents on each one thousand dollars of assessed valuation libr local city voc non business credit owner occupancy non business owner occupancy credit dst spec cnty twp school vill school total class 1 class 2 no. Delinquent tax refers to a tax that is unpaid after the payment due date. Ohio Revised Code sections 572130 to 572143 permit the Franklin County Treasurer to collect delinquent real property taxes by selling tax lien certificates in exchange for payment of the entire delinquency.

Click any locality for a full breakdown of local property taxes or visit our Ohio sales tax calculator to lookup local rates by zip code. The Ohio state sales tax. The Franklin County Treasurers Office will be closed on Monday July 4th for Independence Day.

For tax rates in other cities see Ohio sales taxes by city and county. This is the total of state and county sales tax rates. To learn more about real estate taxes click here.

Sales Tax Table For Franklin County Ohio. 4 rows Franklin. The Franklin County Sales Tax is 125.

The minimum combined 2022 sales tax rate for Franklin Ohio is. ZIP County Rate ZIP County Rate ZIP County Rate ZIP County Rate County Rate Table by ZIP Code July 2022 43001 Licking 725 43002 Franklin 750 43003 Delaware 700 43003 Morrow 725 43004 Franklin 750 43004 Licking 725 43005 Knox 725 43006 Coshocton 775 43006 Holmes 700 43006 Knox 725 43007 Union 700 43008 Licking. The sales tax rate for Franklin County was updated for the 2020 tax year this is the current sales tax rate we are using in the Franklin County Ohio Sales Tax Comparison Calculator for 202223.

All eligible tax lien certificates are bundled together and sold as part of a single portfolio. If you need access to a database of all Ohio local sales tax. You can print a 7 sales tax table here.

2019 - March 31 2019. The County assumes no responsibility for errors. Sales tax in Franklin County Ohio is currently 75.

Search for a Property Search by. Franklin 125 050 750 Putnam 125 700 Fulton 150 725 Richland 125 700 Gallia 150 725 Ross 150 725. The franklin ohio general sales tax rate is 575.

3 rows Franklin County OH Sales Tax Rate. We will resume normal business hours on Tuesday July 5th from 800 am. The Franklin sales tax rate is.

The 7 sales tax rate in Franklin consists of 575 Ohio state sales tax and 125 Warren County sales tax. The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. The minimum combined 2022 sales tax rate for Franklin County Ohio is.

Franklin County sales tax. There were no sales and use tax county rate changes effective. - The Finder This online tool can help determine the sales tax rate in effect for any address in Ohio.

Franklin County in Ohio has a tax rate of 75 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Franklin County totaling 175. All numbers are rounded in the normal fashion. The divisions duties include the collection of delinquent taxes and.

HIGH ST 17TH FLOOR COLUMBUS OH 43215-6306. How much is sales tax in Franklin County in Ohio. John Smith Street Address Ex.

The current total local sales tax rate in Franklin. OH Sales Tax Rate. To calculate the sales tax amount for all other values use our sales tax calculator above.

Ohio state sales tax. There is no applicable city tax or special tax. A county-wide sales tax rate of 125 is applicable to localities in Franklin County in addition to the 575 Ohio sales tax.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 75 in Franklin County Ohio. ICalculator US Excellent Free Online Calculators for Personal and Business use. This is the total of state county and city sales tax rates.

The current total local sales tax rate in Franklin OH is. The Franklin County Treasurer makes every effort to produce and publish the most current and accurate information possible. If this rate has been updated locally please.

Some cities and local governments in Franklin County collect additional local. 123 Main Parcel ID Ex. 6 rows The Franklin County Ohio sales tax is 750 consisting of 575 Ohio state sales.

Overview of the Sale. - Map of current sales tax rates.

Sales Taxes In The United States Wikiwand

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ohio Income Tax Calculator Smartasset

Ebay Sales Tax Everything You Need To Know Guide A2x For Amazon And Shopify Accounting Automated And Reconciled

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

How To Ensure The Right Sales Tax Rate Is Applied To Each Transaction

Ohio Vehicle Sales Tax Fees Calculator Find The Best Car Price

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Ohio Department Of Taxation Facebook

Ohio Sales Tax Rate Changes In July 2022

How To Reduce Virginia Income Tax

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

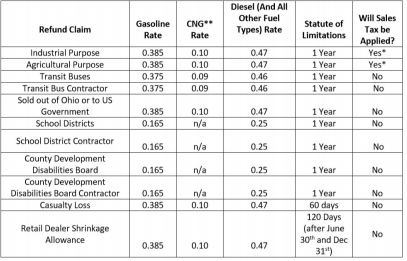

Ohio Raises Motor Fuel Taxes But Not On Everybody Lexology

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation